Table of Contents

Polysilicon Production Equipment Market – Introduction

Polysilicon is one of the purest and quite abundantly found forms of silicon. Polysilicon is used as a raw material for both semiconductors and the electronics industry. Polysilicon is produced by the chemical purification process that involves distilling volatile silicon compounds by further decomposing the silicon at high temperatures. Different kinds of production equipment are used for manufacturing polysilicon, including processing systems, production systems, and reactors. Processing systems used for polysilicon production minimize product contamination in chemical vapour deposition reactors that are used for final packaging. Moreover, the production systems also increase the operational efficiency and cost optimization for the company manufacturing polysilicon.

Report Overview

| Aspect | Details |

| Base year of Estimation | 2016 |

| Value Estimation Year | 2017 |

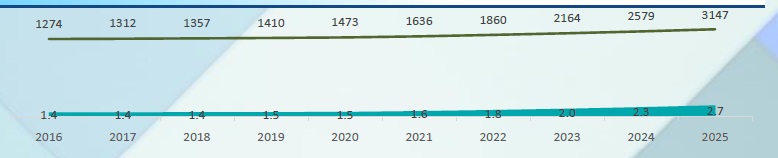

| Forecast Period | 2017 – 2025 |

| Historical Data Period | 2014 – 2016 |

| Regional Scope | North America, Asia Pacific, Europe, Middle East & Africa (MEA) and Latin America |

| Report Coverage | Technology Analysis, Market Dynamics, Market Trends, Segmentation Overview and Competitive Landscape of the market |

Market Segmentation Overview

| Segments | Details |

| By Equipment Type | Reactors, processing system and production system |

| By End Products | Trichlorosilane (TCS), silane and others |

| By Region | North America, Asia Pacific, Europe, Middle East & Africa (MEA) and Latin America |

Key Questions Addressed by the Report

- What will be the nature of growth of the market till 2025?

- What are the major push factors that will affect the growth of the market?

- What are the growth possibilities in different segments of the market?

- Who are the leading market players?

- What are the key strategies implemented by the market leaders to sustain growth in the market?

- What is the major restraining factor of the market?

- What are the ways to generate new revenue streams?

- In-depth analysis of the competitive landscape and competitor behavior in the market.

Technology Analysis

Hydrochlorination is a very common technique that is being used by polysilicon production equipment for the manufacturing of polysilicon. The hydrochlorination technique is a high temperature and pressure process where hydrogen along with silicon tetrachloride is reacted with MGSi, or metallurgical grade silicon, for the manufacturing of trichlorosilane.

Market Dynamics

As of 2016, there has been a growing demand for polysilicon production as a result of its growing applications in the semiconductor and electronics industries, contributing to the growing demand for polysilicon production equipment market globally. Rising demand for polysilicon production equipment has also been fueled by the high-end production and construction qualities that will further help this market grow globally. The growing focus on developing renewable sources of energy has also fueled the demand for solar cells as well as applications for solar cells. This has become another major factor that has positively impacted the demand for polysilicon production equipment that has huge applications in solar cells.

The market for polysilicon is niche and is still at a nascent stage, with applications still being limited to a few industries. This, along with the huge costs associated with the implementation of this technology, forms some of the major restraints for the global polysilicon production equipment market. The deployment of chemical vapour deposition technology in reactors has increased the scope of applications of polysilicon production equipment related to the integration of ingots directly into semiconductor modules.

Market Trends

In recent years, the application of complex polysilicon fabrication techniques has increased drastically due to their growing usage in the semiconductor and electronics industry. With this, the demand for polysilicon has also increased as a result of its usage in the wafer fabrication process, which has in turn also fuelled the demand for advanced polysilicon production equipment. In terms of market structure, the consolidated market for polysilicon production equipment has resulted due to the presence of small numbers of large players.

Some of the major production bases for polysilicon production equipment are located in the U.S. In order to retain their market position and generate a new revenue stream, manufacturers present in this industry are focusing on product innovation in terms of the size of the polysilicon chips, the complexity of the fabrication process, and the growing applications for polysilicon in different industries as well. For example, research and development work is going on to further implement as well as commercialize the thin and smaller chips of polysilicon. The introduction of advanced applications of photovoltaic (PV) cells for solar power is expected to help the market for polysilicon production equipment grow in coming years.

Segmentation Overview

The market for polysilicon production equipment has been segmented based on equipment type, end products, and geography. Some of the major application areas for polysilicon production equipment are the manufacturing of PV cells for solar power as well as the electronics industry.

By Equipment Type

By equipment type, the market has been segmented into reactors, processing system and production system.

- Reactors,

- Processing system, and

- Production system

By End Products

On the basis of end products, the market has been further segmented into trichlorosilane (TCS), silane, and others. In terms of revenue, trichlorosilane produced through the technique of hydrochlorination had the largest share in 2016, and this trend is expected to continue throughout the forecast period. Use of this technique for trichlorosilane production through the chemical vapour deposition reactors brings down the cost of production and thereby increases the overall revenue generated from the polysilicon production equipment market.

- Trichlorosilane (TCS),

- Silane and others

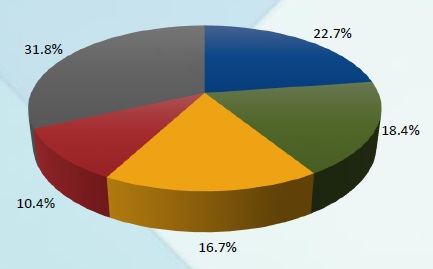

By Regions

The geographical segmentation for the global polysilicon production equipment market includes North America, Asia Pacific, Europe, Middle East & Africa (MEA), and Latin America. In terms of revenue, North America held the largest share of this market due to its high demand for solar cells as well as a rise in the electronics industry. In 2016, North America formed the largest market for polysilicon production equipment, whereas Asia-Pacific accounted for the fastest growing segment in this market globally.

- North America,

- Asia Pacific,

- Europe,

- Middle East & Africa (MEA), and

- Latin America

Competitive Landscape

Leading players operating in the polysilicon production equipment market are GT Advanced Technologies (the U.S.), Poly Plant Project Inc. (the U.S.), and Fluor Corporation (the U.S.), among others. China forms one of the major regions that produce polysilicon globally. In terms of polysilicon production equipment, North America forms a major region for this market, along with the usage of advanced equipment and techniques for the manufacturing of polysilicon. Furthermore, companies operating in this market, such as GT Advanced Technologies, focus heavily on developing advanced equipment for silicon production, such as using the fluidized bed reactor process. As compared to Asia and North America, the concentration of polysilicon production equipment manufacturers is comparatively low in countries like Europe.

Conclusion

Considering the dynamic business scenario, product innovation, growth in export of polysilicon production equipment, and increasing usage of renewable resources, it is expected that the market will grow during the forecast period of 2017 to 2025. Furthermore, it is the emergence of newer applications in the electronics and semiconductor industries that is also likely to act as a major long term push factor for the growth of the polysilicon production equipment market. All these factors are estimated to contribute to the overall growth of the market in coming years.